Quarterly report | Q2 | Baltic States

Property

Snapshot

Q2 | 2022

Investment market

The capital market in Estonia continued the year, showing modest activity with total investment volume exceeding EUR 80 million in Q2 2022 and more than half of the activity observed in the industrial segment. Capitalica acquired a logistics complex, consisting of two newbuilds (9,500 sqm) in Jüri Industrial Park, while Direct Invest purchased a complex of warehouses in Iru Industrial Park. Additionally, Titanium became the new owner of the Saku Metall property (sale-leaseback deal) located in Rae parish. Notable deals in the office segment included the sale of the recently redeveloped Pärnu Rd 132 office building to Colonna and acquisition of the Sõle 14 complex (former Telia premises, partial sale-leaseback deal) by EKE. Yields currently remain unchanged but higher interest rates are likely to put some upward pressure on yields, suppressing investment activity in 2HY 2022.

Key Investment Figures in the Baltic States, Q2 2022

Prime Yields

Estonia

Latvia

Lithuania

Office

5.5%

5.5%

5.25%

Retail

6.7%

7.0%

7.0%

Retail (grocery-led)

6.0%

6.5%

6.0%

Industrial

6.7%

6.5%

6.5%

Source: Colliers

In Q2 2022, investment volume in Latvia reached EUR 85 million. Due to the ongoing war in Ukraine and high market uncertainty, the market was less active in March-April as some deals were revoked. Acquisition of SC Damme by Summus Capital was the largest deal of the quarter, followed by Lumi Capital’s acquisition of Indi Centrs (Class B Office Building). Additionally, several smaller retail objects changed owners (e.g., EF Mall purchased Elkor Plaza, a big-box department store). The development segment became more active in the second half of the quarter. Three development properties were acquired in Riga centre – Estera acquired the planned Rotermann Quarter territory for 10.7 mEUR, Estmak acquired Lacplesa 76 for 6.5 mEUR and VPH acquired the former Rigas Piena Kombinats site for 4.5 mEUR, while industrial developers Piche & Sirin continued to acquire land plots around Riga Airport. The market remains active and several notable transactions are expected in the following quarters. Most of the interest comes from investors that are already familiar with the Baltics and have invested here before. Yields currently remain stable.

After a very buoyant last year, which turned into an active start to 2022, investment activity in Lithuania showed even stronger performance in Q2 with total investment volume amounting to almost EUR 170 million. Considerable activity was driven by high-volume deals in the office and retail segments. Groa Capital reached agreement with development company Galio Group to acquire the Freedom 36 Office Building in Laisves Ave. for almost EUR 40 million (one of the largest transactions in Lithuania in 1HY 2022). In the retail segment, KS Holding completed a large transaction, selling the Senukai DIY store (10,000 sqm, opened at end 2021) to Titanium Baltic Real Estate, a Finnish investment management company. In terms of total value, the office segment accounted for the largest share, followed by retail, and then the industrial sector in third place, with smaller but significant deals. Yields in all segments remained stable compared to the previous quarter.

Office market

Development in the Tallinn office market remains constantly active with total GLA of 165,800 sqm (15.1% of total stock; 18 projects) under construction in June. Rising construction costs continue to heavily impact asking rents as well as the prospect of further development activity. That said, Q2 2022 saw the start of demolition work on the Ahtri 6 site for development of the Golden Gate project in CBD. Demand is continually driven by relocations and expansions in the ICT, blockchain, professional (lawyers) and healthcare sectors (several medical clinics are constantly on the lookout for premises in CBD). Although several companies announced plans to terminate / cut their operations in Estonia, so far vacancy continues to fluctuate around 7%, seeing some consistent decline below the 6% level in Class A buildings.

Key Office Figures in the Baltic States, Q2 2022

Class

Tallinn

Riga

Vilnius

A Class Rents

15-19

14-17

15.5-18

B1 Class Rents

9.9-16

9-14

10-14.5

A Vacancy*, %

5-6%

20-21%

4-5%

B1 Vacancy*, %

7-8%

14-15%

5-6%

Source: Colliers . EUR/sqm/month; *-speculative office market vacancy rate

Despite the rapid rise in construction prices, 2 new projects entered the active construction phase in Riga: Barona 30a Office Building (a continuation of the Pērses 2a project) and the first of the two Magdalenas Quarter Office Buildings, adding nearly 8,000 sqm to the total construction pipeline of 159,250 sqm. Meanwhile, Q2 saw completion of the Rimi HQ (renovation and expansion of the office and logistics complex). Regardless of the geopolitical situation and uncertainty, tenants’ interest remained high. Due to rising additional costs, tenants are increasingly examining energy-efficient office solutions. Nevertheless, the rise in fit-out costs and sometimes insufficient landlord contributions were disrupting some tenants' plans. As a result of high costs and use of a hybrid work model, an increasing tendency to space reduction during relocations was observed.

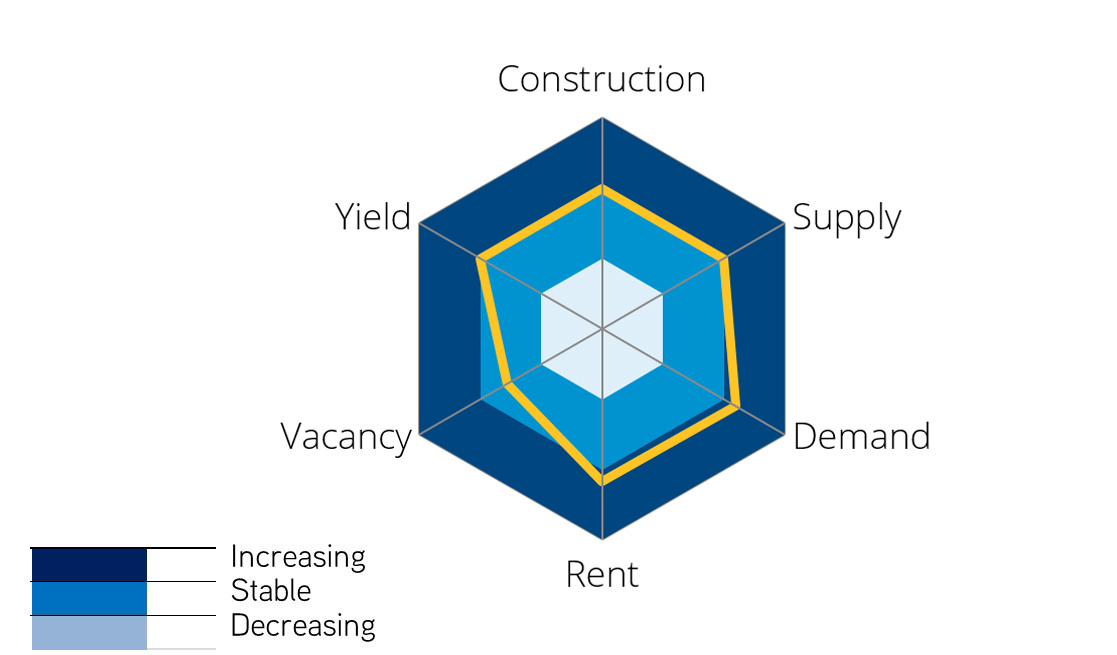

Office Trends

Source Colliers

In Q2 2022, the Vilnius office market expanded by two new projects - Paupio Darboteka and Aludariu 1 with total GLA of almost 10,000 sqm. In Q2, the market was characterised by rapid take-up and declining supply of office space, mainly due to the recent relocation of foreign IT companies looking for large modern premises, which reduced the ability of smaller companies to find suitable premises. Development of new office space has remained strong, with a total of 177,000 sqm of leasable office space under construction, of which around half should be completed by the end of this year. The number of lettings was also strong, with total take-up volume exceeding 31,000 sqm.

Rent rates have slightly changed due to new higher quality projects coming to the market.

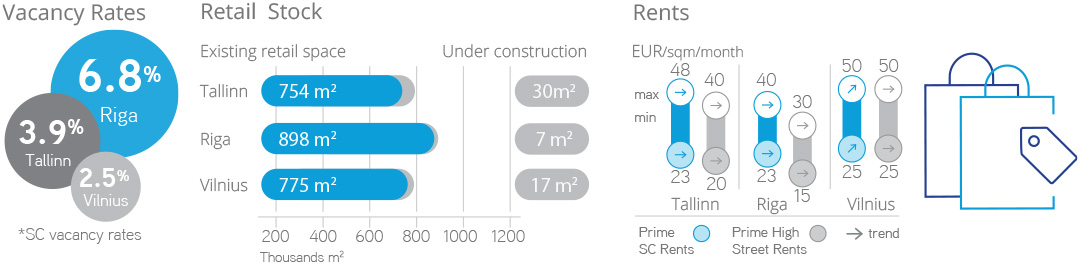

Retail market

The Tallinn retail development market continues to remain largely inactive, with no new projects added to the market and still no new remarkable additions expected during 2022. Shopping centres continue diversification of their tenant mix. In June, Viru Keskus SC opened ILUSFÄÄR, a beauty, health and wellness centre (key tenants – Confido, MakeYourID, Niine Nahakliinik, NailSpa) and a Food Hall concept area – a 1,500 sqm wide indoor avenue boasting 15 restaurants. New big tenants in Nautica Centre include Rademar and JYSK, while year-end should see the opening of MyFitness sports club in Kristiine Centre, occupying ca 2,000 sqm. As a result of some planned tenant changes as well as improving sales and footfall figures, a visible decrease is also seen in shopping centre vacancy. A considerable improvement in footfall in Old Town and City Centre has additionally been driven by recovery in the hospitality sector during April-June.

In Q2 2022, the Riga retail market remained active, seeing acquisition of former industrial sites close to the city centre by VPH with the goal of developing a new retail property by end-2024, while Summus Capital made its third retail property acquisition in Riga by purchasing SC Damme. Q2 was the first full quarter after

Retail Trends

Source Colliers

Covid-19 restrictions were lifted and several malls managed to regain 2019 footfall figures. Overall, retail market sentiment has improved with growing demand seen from both existing and new market players. New market entries include Candy POP and KOS KOS as well as SPAR announcing the opening of its first stores in Q3 2022. In Q2, Super Skypark and a third Apollo cinema opened in SC Domina Shopping, while Hortes − which entered the market during the pandemic − closed its only store in SC Sāga. Increased demand for good quality regional space continues, positively impacting rents in regions that currently are already at the same level as for secondary SCs in Riga. As the tourism industry is recovering, interest in street retail is also on the increase. Former Tokyo City street retail premises in Riga have been leased to Lido and Gan Bei.

In Q2 2022, the Vilnius retail market saw the start of land works on construction of a SC at Dangerucio St. 1 (GBA 16.600 sqm), with completion expected in 2023, as well as reconstruction works on SC Panorama. Active construction of new Lidl and Rimi supermarkets was the main activity in the market and Silas, a new brand entering the Vilnius retail market, is currently building its first store in Pilaite district. Selection of vacant premises in Vilnius prime shopping centres remained tight. Increased utility costs remain a major challenge for restaurants and coffee shops, while rent rates continue to fluctuate within the current range, although there is a slight upward pressure on rent rates.

Key Retail Figures in the Baltic States, Q2 2022

Tallinn

Riga

Vilnius

Prime SC Rents*

23-45

23-40

25-50

Prime High Street Rents*

25-40

15-30

25-50

Vacancy in SC

3.9%

6.8%

2.5%

Source: Colliers . *EUR/sqm/month; SC – shopping centre

Industrial market

The industrial segment remains active in Tallinn and its suburbs in terms of new developments with a total area of approx. 150,000 sqm (28 projects) under construction in June and many projects in the completion phase. Rising construction prices continue to heavily impact asking rents for new premises. As a result, the number and volume of new projects started during the quarter have somewhat eased, while tenants are tending to look more for existing buildings / older premises and/or start to renew their lease agreement in their current location, although at a higher rent (5.5-6.5 EUR/sqm). Development of stock-office premises continues to remain active with at least 67,100 sqm (14 projects) under construction, although demand / pre-lease activity shows signs of easing in the segment.

Key Industrial Figures in the Baltic States, Q2 2022

Tallinn

Riga

Vilnius

Prime Rents*

5.0-6.5

4.0-4.7

4.2-5.0

Vacancy

2.8%

1.6%

0.8%

Source: Colliers . *EUR/sqm/month

In Q2 2022, construction of several industrial projects was completed in Riga region, including the new Orkla Biscuit and Wafer Factory (23,000 sqm), the MDL warehouse in the Airport area (8,800 sqm), the Deposit System Operator building, and stage I of the Mežlīdes stock office complex. High demand and low supply of large-scale projects have led to increased activity in the BtS segment, although this is not always the most cost-effective solution, pushing tenants to return to the speculative market. Tenants operating with transit to Russia and Belarus have suffered from sanctions imposed, although the effects are not yet apparent in vacancy figures, since long-term lease agreements are still in force and vacated space might be offered on a sub-lease basis. The upper level of prime rent rates rose from 4.7 to 5.0 EUR/sqm. Projects that rely on gas heating are looking for alternative energy sources, including solar and geothermal energy. Developers continue to expand their land portfolios – Sirin acquired a large land plot (39 ha) next to Riga Airport and announced an upcoming project of GLA 180,000 sqm.

In Q2 2022, the J55 LC (the 1st part of stage II) developed by SIRIN was completed in the Vilnius warehouse market, adding 20,400 sqm to speculative stock, while no new projects were added to the development pipeline. By quarter-end, six projects (GBA 67,200 sqm) remained under construction. In addition, Darnu Group completed construction of Vilnius Business Park, a 24,000 sqm stock-office project, while completion of another three smaller stock-office projects added 8,900 sqm. In Q2, demand for warehouse space remained strong, reflected in total take-up of over 26,000 sqm. Leafood vegetables production company signed a lease agreement for 4,000 sqm at Transimeksa LC. Rent rates have slightly increased, while vacancy remains low, standing at only 0.8%. Although construction prices are stabilising, developers are still facing problems with getting building permits and partial breakdown of supply chains, which affects development activity in the I&L market. The war in Ukraine and the sanctions imposed on Russia and Belarus have not yet had a noticeable impact on the I&L market, although businesses / companies have expressed some concerns regarding this situation.

Industrial Trends

Source Colliers

Trends for 2022

- As real estate has been always seen as a good hedge against inflation, interest in investing in cash-flow objects during a high-inflation period is expected to remain strong.

- At the same time, higher interest rates are likely to place some upward pressure on yields and suppress investment activity for the rest of the year.

- The geopolitical situation is forcing market players to pay increased attention to both tenant and landlord risks.

- Investors are expected to continue the hunt for industrial assets as well as to target more new / niche investment products, such as residential rental, student and senior housing.

- Rising construction and utility costs, growing interest rates as well as high demand are heavily impacting asking rents for new premises.

- Start of new developments depends on the time needed for construction costs to stabilise and assurance that business plans will work at new construction price levels. Some development will be delayed because of the increased uncertainty.

- Although the pipeline of offices under construction is huge, notable vacancy increase is not forecast.

- Several ambitious new projects in the pipeline are expected to be implemented in the medium run.

- Attention to sustainable buildings, the green economy and energy saving issues is growing.

- Landlords are actively looking for options to improve the energy efficiency of their existing and planned developments in order to reduce costs for their tenants.

- The rising cost of living is impacting households’ purchasing power, which in turn might negatively affect retail market results and prospects.

- The unstable and uncertain epidemiological situation will continue to adversely impact rents and vacancy levels in the retail market across the Baltics.

- Refurbishment, expansion, improvement and diversification of the tenant mix will remain on the main agenda for SC landlords and retail investors.

- The industrial market is expected to continually enjoy a low vacancy level, driven by buoyant demand.

- Supply of stock-office premises will remain low in Riga with very limited availability of vacant space.

Contact

Maksim Golovko

Research & Forecasting | Estonia

Colliers International Advisors

Estonia Office

+372 6160 777

Toms Andersons

Research & Forecasting | Latvia

Colliers International Advisors

Latvia Office

+371 67783333

Denis Chetverikov

Research & Forecasting | Lithuania

denis.chetverikov@colliers.com

Colliers International Advisors

Lithuania Office

+370 5 2491212

colliers.lithuania@colliers.com

© 2022 :: Colliers International